Fundamental Analysis

What is Alphabet? Alphabet is mostly a collection of companies. The largest of which, of course, is Google. This newer Google is a bit slimmed down, with the companies that are pretty far afield of our main internet products contained in Alphabet instead. What do we mean by far afield? Good examples are our health efforts: Life Sciences (that works on the glucose-sensing contact lens), and Calico (focused on longevity). Fundamentally, we believe this allows us more management scale, as we can run things independently that aren’t very related.

Reasons to buy – Alphabet

High level decisions on buy or sell for a stock should be driven by

1. The margin that the company makes. i.e. Out of $1 that the company sells how much does the company taken home.

-

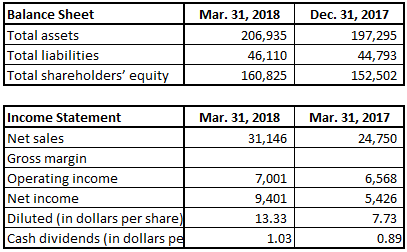

- Here we see Alphabet makes a margin of 23% on Operating Level and about 30% on Net level. This means that out of $1 that it makes $0.3 is being pocketed as profits.

2. The growth rates of the company on revenue, net income, EPS and Dividend. i.e. If it sold $1 last year how much more did it sell this year.

-

- Here we see net revenue growth of 26% in the revenue and the net profit figures grew by 73%.

3. The efficiency ratios of the company on Equity and Assets. i.e. How well is the company able to sweat each $1 that it puts to work in the company.

-

- Here we see Alphabet makes a Return on Assets of 19% and Return of Equity of 24% which is pretty good.

Probably one of the stocks you shouldn’t even have to think about just the way that you hardly think before going to google.com for searching anything and everything in the world. Any company that makes about $9 Billion in profits and yet manages to grow at this rate is worth investing. The idea is not just to invest in Alphabet but find the other companies that are much smaller having similar parameters and that can achieve the size and scale of Alphabet.

GOLD STANDARD : This is one of the no-debate stocks that are a must have in ones portfolio.

The larger point that needs to be noticed is that all the big and great companies like FACEBOOK, ALPHABET etc all get caught by our barrier rates. This shows the credibility of our barrier levels. If we get the smaller companies who are performing at the same Fundamental Parameters as Alphabet, and provided they grow at the same rate to a reasonable size hopefully we can get some multibaggers is the idea.

All these ratios can be found in the attached excel sheets and are based on the EDGAR report submitted by Alphabet to the SEC. All the data on the above analysis can be found at the link below

Balance Sheet

Income Statement