Fundamental Analysis

Norwegian Cruise Line is the innovator in cruise travel with a 51-year history of breaking the boundaries of traditional cruising. Most notably, Norwegian revolutionized the cruise industry by offering guests the freedom and flexibility to design their ideal cruise vacation on their schedule with no set dining times, a variety of entertainment options and no formal dress codes. Today, Norwegian invites guests to enjoy a relaxed, resort-style cruise vacation on some of the newest and most contemporary ships at sea with a wide variety of accommodations options, including The Haven by Norwegian®, a luxury enclave with suites, private pool and dining, concierge service and personal butlers. Norwegian Cruise Line sails around the globe, offering guests the freedom and flexibility to explore the world on their own time and experience up to 27 dining options, award-winning entertainment, superior guest service and more across all of the brand’s 16 ships.

High level decisions on buy or sell for a stock should be driven by

1. The margin that the company makes. i.e. Out of $1 that the company sells how much does the company taken home.

-

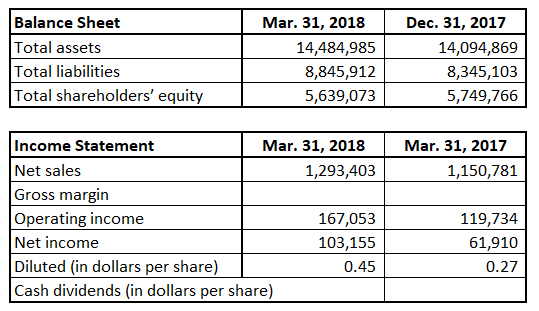

- Here we see Norwegian Cruise Line Holdings makes a margin of 13% on Gross Level and about 8% on Net level This means that out of $1 that it makes $0.08 is being pocketed as profits.

2. The growth rates of the company on revenue, net income, EPS and Dividend. i.e. If it sold $1 last year how much more did it sell this year.

-

- Here we see Norwegian Cruise Line Holdings grew at an good rate of 12% in the revenue and the net profit figures grew by 67%.

3. The efficiency ratios of the company on Equity and Assets. i.e. How well is the company able to sweat each $1 that it puts to work in the company.

-

- Here we see Norwegian Cruise Line Holdings makes a Return on Assets of 3% and Return of Equity of 7% which is pretty good.

Here we see that Norwegian Cruise Line Holdings scores poorly on Return on Assets and Return on Equity. The maintenance of the huge cruise liners leads to huge capital outlays and hence pushes down the Efficiency parameters.

The huge floating hotels with the casinos and lavish attractions are a dream for middle class, but the huge Fixed Asset deployment that goes into generating $1 makes the business an inefficient business. Probably skip unless you have all the other ducks in your portfolio.

All these ratios can be found in the attached excel sheets and are based on the EDGAR report submitted by Norwegian Cruise Line Holdings to the SEC. All the data on the above analysis can be found at the link below

Balance Sheet

Income Statement