Fundamental Analysis

Did You Know?

Costco Wholesale is a multi-billion dollar global retailer with warehouse club operations in eight countries. We are the recognized leader in our field, dedicated to quality in every area of our business and respected for our outstanding business ethics. Despite our large size and explosive international expansion, we continue to provide a family atmosphere in which our employees thrive and succeed. We are proud to have been named by Washington CEO Magazine as one of the top three companies to work for in the state of Washington.

What Is Costco?

Costco is a membership warehouse club, dedicated to bringing our members the best possible prices on quality brand-name merchandise. With hundreds of locations worldwide, Costco provides a wide selection of merchandise, plus the convenience of specialty departments and exclusive member services, all designed to make your shopping experience a pleasurable one.

Reasons to buy – COSTCO

High level decisions on buy or sell for a stock should be driven by

1. The margin that the company makes. i.e. Out of $1 that the company sells how much does the company taken home.

-

- Here we see COSTCO makes a margin of 3.1% on Gross Level and about 2.1% on Net level This means that out of $1 that it makes $0.021 is being pocketed as profits.

2. The growth rates of the company on revenue, net income, EPS and Dividend. i.e. If it sold $1 last year how much more did it sell this year.

-

- Here we see net revenue growth of 11% in the revenue and the net profit figures grew by 36%. Note the Dividends have increases by 15% which is a sign that the company is willing to give back cash to the shareholders.

3. The efficiency ratios of the company on Equity and Assets. i.e. How well is the company able to sweat each $1 that it puts to work in the company.

-

- Here we see COSTCO makes a Return on Assets of 0.01% and Return of Equity of 0.02% which is pretty good.

Note that COSTCO has very poor margins and extremely poor efficiency margins. This is one of the investments of Warren Buffett. This shows that though the company may have extremely famous investors the company itself needs to be analysed using these basic parameters to decide whether we should be investing in it or now. Ignore this one for now.

All these ratios can be found in the attached excel sheets and are based on the EDGAR report submitted by COSTCO to the SEC. All the data on the above analysis can be found at the link below

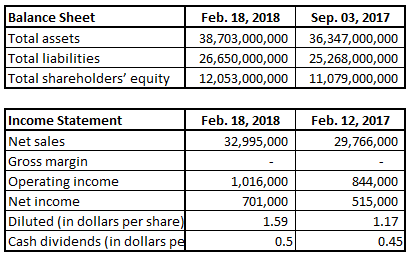

Balance Sheet

Income Statement